The crime is that we are ruled by a self-perpetuating elite of monetary cranks

David Stockman | Zero Hedge - FEBRUARY 18, 2016

Larry Summers is a pretentious Keynesian fool, but I refer to him as the Great Thinker’s Vicar on Earth for a reason. To wit, every time the latest experiment in Keynesian intervention fails – as 84 months of ZIRP and massive QE clearly have – he can be counted on to trot out a new angle on why still another interventionist experiment or state sponsored financial fraud is just the ticket.

Right now he is leading the charge for the greatest stroke of foolishness yet conceived. Namely, negative interest rates based on the rubbish theory that the “natural” money market rate of interest is at an extraordinarily low point. Accordingly, the central bank should drive the “policy rate” to sub-zero levels in order to achieve the appropriate level of “accommodation” in an economy that refuses to attain “escape velocity”.

As can’t be pointed out often enough, however, there is no such economic ether as “accommodation”. It’s just a blanket cover story for what Keynesian central bankers believe they are accomplishing by pegging interest rates below market clearing levels and by bending and mangling the yield curve to cause more investment.

But after 86 months it is evident that all of this putative monetary “accommodation” has failed. Falsifying the cost of money and capital can only work if it causes households and businesses to borrow more than they would otherwise; and to then lay credit based spending for consumption and investment goods on top of what can be funded out of current production and income. Another name for that is leveraging private balance sheets and thereby stealing production and income from the future.

With $62 trillion of public and private debt outstanding, however, the US economy has hit a economic barrier called Peak Debt. For all practical purposes, it can be measured as the macroeconomy’s aggregate leverage ratio, which now stands at 3.5X national income. That represents fully two extra turns of debt on the economy relative to the stable 1.50X ratio that prevailed during periods of war and peace and boom and bust during the century before 1970.

Stated differently, the Fed and other central banks have led the world economy into a planetary LBO over the last two decades or so. In the case of the US, the two extra turns of debt resulting from that rolling LBO amount to about $35 trillion.

Yes, that’s a load of anti-growth ballast that explains why there has been no “escape velocity”, and why the rate of real final sales growth since Q4 2007 is only1.3%compared to peak-to-peak historical rates of 2.5% to 3.5%.

And I use peak-to-peak advisedly because it is now clear after the recently released December business sales and inventory numbers that we are on the verge of a recession, if not already in one. Total business sales were down 4.6% from their July 2014 peak and the business sales to inventory ratio rose again to a recessionary high of 1.39X.

Yet the Vicar and his compatriots in the Eccles Building and on Wall Street insist on pushing harder on the credit string——even though Peak Debt means that household debt is still $400 billion below its pre- crisis peak and that the entire $2 trillion gain in business debt has been recycled back into the Wall Street casino via stock buybacks and mindless M&A deals. Real net investment in business plant, equipment and technology, in fact, is actually still 18% below its 2007 peak, and even the level which had been attained at the turn of the century.

So that brings us to the harebrained theory of negative interest rates and the supposed collapse of the “natural rate” of interest on the money market. The latter proposition is just unadulterated economic voodoo. It makes Art Laffer’s magic napkin look like a model of scientific formulation by comparison.

The truth is, there is only one “natural rate” of interest, and that’s the one produced in an honest financial marketplace via the interaction of savers and borrowers. No such rate now exists and hasn’t for decades owing to the massive intrusion of the Fed in the money market. Indeed, as a purely physical matter, even the so-called Federal funds market no longer exists because the Fed has asphyxiated it under a flood of $3.5 trillion of bond-buying and the resulting giant surplus of bank deposits.

So professor Summers is apparently speaking for the kid who killed his parents and then threw himself on the mercy of the courts on the grounds that he was an orphan. That is, interest rates are in the graveyard of history because the central banks buried them there.

Interest rate pegging and the Fed’s wealth effects doctrine have failed completely, but now Keynesians like Summers claim the contra-factual.

That means the Keynesian medicine didn’t work because the Fed didn’t pump enough monetary stimulants drugs into the nation’s already drug-addled body economic. So now we have to dig even deeper into the netherworld of financial repression in order to align borrowing costs with a non-existent natural rate of interest.

It’s another case of a policy target confected from whole cloth just like the 2% inflation target. But there is one overwhelming practical problem with NIRP. To wit, if it is pushed deeper and broader than just a few basis points of negative yield on deposits of excess bank reserves at the central bank, NIRP will surely cause a flight to old-fashioned bank notes. There will be a booming business in bank note moving and storage.

So, lo and behold, after all these years of doctoring the economy, Professor Summers and fellow travelers like Professor Peter Sands at Harvard, have up and joined the war on crime!

But their newfound abhorrence of crime amounts to an economist’s version of the NRA mantra that guns don’t kill, people do. In this case, it might be said that criminals don’t launder money, avoid taxes and commit act of terrorism, large denomination bills do!

Of course, the latter have been around for centuries. Yet suddenly every NIRP advocate on the planet has joined the campaign to abolish large bills including the Benjamin Franklin here and the EUR 500 note on the other side of the pond.

Thus, Professor Summers opined as followed in a recent Washington Post op ed:

The fact that — as Sands points out — in certain circles the 500 euro note is known as the “Bin Laden” confirms the arguments against it. Sands’ extensive analysis is totally convincing on the linkage between high denomination notes and crime. He is surely right that illicit activities are facilitated when a million dollars weighs 2.2 pounds as with the 500 euro note rather than more than 50 pounds as would be the case if the $20 bill was the high denomination note. And he is equally correct in arguing that technology is obviating whatever need there may ever have been for high denomination notes in legal commerce.

Let’s see. A million dollars worth of weed currently weighs about200 pounds. If push came to shove couldn’t El Chapo have the mules who deliver it to the street carry 50 pounds of bills on the backhaul? Better still, if drug money laundering is such a huge social blight, why not legalize the drug trade and turn the business over to Phillip Morris?

They would surely use digital money to pay their vendors. And if we want to get rid of tax evasion does the good professor really believe that Wall Street high rollers and silicon valley disrupters or just every day rich people actually get paid for whatever they do in bank notes?

The fact is, it is gardeners, waitresses and delivery boys who get paid in cash, not people with meaningful incomes. Yet bringing such putative slackers to justice doesn’t require the abolition of cash in any event. Just exempt them from income and payroll taxes entirely and let them pay their societal dues at the cash register when they purchase goods and services.

In short, there is one reason alone for the sudden campaign to abolish large denomination bills. It is a necessary predicate for the imposition of NIRP. That is to say, it would pave the way for central bank mandated confiscation of the wealth and savings of millions of American citizens in the pursuit of a cockamamie theory that would bring about the final destruction of honest price discovery and financial discipline in the Wall Street casino.

Surely, there is not much more of such destructive intervention that can be tolerated before the booby-traps of leverage and risk that have been built up over the last two decades, but especially since the financial crisis, blow sky high. Indeed, the very idea that the foolish advocates of Keynesian central banking would even entertain the notion of providing outright subsidies to carry trade gamblers—–and that’s where money market NIRP would end up——is a warning sign of the danger that lurks in the financial misty deep.

During the printathon since 2008, Central bankers have been massively and relentlessly deforming financial markets and rewarding the most outlandish and unstable forms of leveraged gambling and risk-taking throughout the warp and woof of the financial system. Yet they have no more clue about the financial time bombs they have planted than they did last time around when CDS and CDOs squared were erupting everywhere.

It is only a matter of time, and a few more bear market rallies, before the meltdown commences again. Indeed, when the impending global recession becomes fully evident, the gamblers in the Wall Street casino will panic like never before.

After a 30-year bubble, they have come to believe that the central banks are infallible and that all economic downturns and market corrections are quickly remedied with new rounds of monetary stimulus. But that is not a permanent financial truth; it’s a false generalization based on a fabulous one-time monetary trick that is already played out.

To wit, central banks have used up their dry powder. After more than two decades of reckless monetary pumping, they are now stranded on the zero bound and possessed of hideously bloated balance sheets.

So the correction scenario this time will be very different. There will be no quick reflation, meaning that the liquidation of economic malinvestments and overvalued financial assets will run for years.

In fact, during the coming down-cycle, the central banks may turn out to be wreckers, not saviors. As they resort to increasingly novel and illogical maneuvers such as negative interest rates (NIRP) they are generating fear, not confidence.

There can be no better proof than what has transpired in Japan since its lunatic central banker, Haruhiko Kuroda, announced a shift to NIRPwithin days after he said it was off the table. Since his January 29 statement, however, the Japanese stock market has plunged by 16% from its early January level and 25% since last summer’s peak, thereby wiping out much of the three-year long stock bubble generated by Abenomics.

^N225 data by YCharts

Nor is Japan’s stumble an isolated case. Warning signs on the epochal shift now underway continue to accumulate on all fronts. The bellwether economies of Asia started the year with a sharp plunge, including a 11.5% export decline compared to last January in China, a 13.5% drop in India and an 18.5% plunge in South Korea.

Likewise, Germany ended 2015 with an unexpected decline in exports and industrial production, while Japan’s trade figures also slipped badly—-with exports down 8% and imports off by 18% versus prior year. Consequently, the Japanese economy posted a recessionary 1.4% contraction of GDP in Q4.

There is no better weathervane on the global economy than the Baltic Dry Index because it captures the daily pulse of global shipments of grains, iron ore and the rest of the commodity complex. The fact that it has now plunged to an all-time low since records began in 1985 underscores that worldwide industrial activity is sinking rapidly.

In response to these deflationary currents, financial markets have retreated sharply on a worldwide basis. Among 44 significant international equity markets, nearly half are already in bear market territory as signaled by a drop of 20% or more from recent highs. And some of the most pivotal markets in the world——-Germany (DAX), Japan and China—–are down by 30% or more.

Not surprisingly, these drastic declines have so far only dented the surface on Wall Street. The unreconstructed bulls are already saying that the correction is over and are urging their clients to once again buy the dip. Nearly ever one of the major banking houses have year-end price targets for the S&P 500 well above current levels. These include a gain of 11% at Goldman, 15% at Morgan Stanley, 16% at Barclay’s and 17% at RBC Capital.

A cynic might dismiss this ebullience as merely an exercise in the usual Wall Street hockey stick game. After all, you can’t sell stock, ETFs and other financial products to investors when you are projecting a down market, and so they never do.

Yet chalking these dubious targets off to salesmanship would be to underestimate the magnitude of the coming crash.The truth of the matter is that Wall Street gamblers, like the Jim Carrey character in The Truman Show, have lived in the bubble for so long that they no longer even remotely grasp the artificiality and unsustainability of the entire financial system.

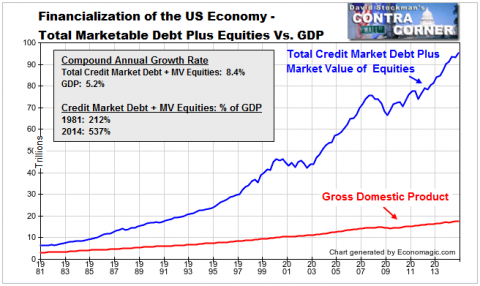

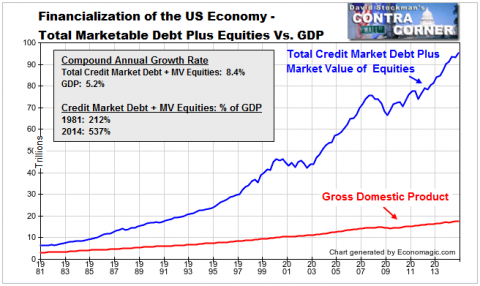

We think the chart below puts this in perspective. For the better part of three decades, the financial system in the US has been expanding at nearly twice the rate of GDP growth. Even a vague familiarity with the laws of compound arithmetic reminds us that the resulting ever-widening gap between economic output and the market value of stock and debt obligations can’t continue.

But there is an even larger point. Namely, that the weakening performance of the US economy during the last two decades did not warrant the drastic increase in the capitalization rate implied by the chart in the first place.

Stated differently, equities and debt must ultimately be supported by interest and dividends extracted from the flow of national income (GDP). Historically, the stable US financial capitalization rate—that is, the combined value of debt and equity outstanding— had been about 2.0X national income. But beginning with Greenspan’s conversion to money printing after the financial meltdown of October 1987, the capitalization rate begin to steadily climb and never looked back.

Now it amounts to nearly 5.4X national income. Yet this has occurred during a period when the trend growth rate of the US economy has been cut in half——from more than 3.0% per annum to less than 1.3% during the eight years.

Measured in dollar totals, the sum of equity and debt outstanding in the US in 1987 was $11 trillion. Today it exceeds $93 trillion. No wonder asset gatherers like Blackrock have exploded in scale!

But that’s also why they are heading for a big fall. As the post-bubble epoch of global recession and financial deflation and liquidation unfolds, the $93 trillion US financial bubble shown below will contract sharply, as will its equivalent worldwide total of $300 trillion.

So we are looking at tens of trillions of financial asset shrinkage in the years ahead. And nowhere will that implosion be more dramatic than in the ETF sector.

As shown in the chart below, the number of these entities has grown from about 600 to 5,500 in the last 12 years, and AUM has exploded from $450 billion to $3 trillion.That’s a 21% compound rate of growth since 2005.Even more significantly, almost all of that growth occurred after the 2008 financial crisis.

So let’s cut to the chase. Prior to Greenspan’s dotcom bubble, ETFs did not even exist, and they would never thrive on an honest free market. That’s because their fundamental appeal is to professional speculators and traders and to homegamers who like to bet on the financial ponies.

By contrast, there is no reason why real long-term investors would want to own a huge, motley basket of banking stocks or energy stocks or the likes of the biotech ETF portfolio. The latter (IBB) includes 150 different stocks including nearly 100 start-ups whose science is extremely difficult to assess and whose P&Ls are largely non-existent.

The sole purpose of the IBB, therefore, was to enable speculators to pile on to the momentum trade in biotech stocks which incepted about 2012. This momentum trend was then turbo-charged by the inflow of speculative capital into this sector through IBB and other ETF’s.

The same thing happened with the energy ETFs. One of the major ETF baskets in this sector is called XLE and it includes 40 energy companies ranging from giant integrated producers like Exxon to refiners like Valero, to oilfield services companies like Halliburton, to small E&P companies like Newfield Exploration. The iShares equivalent is called IXC and it is even more diversified with 96 companies spread among an even greater diversity of sizes, specializations and geographies.

Needless to say, no long-term investor would possibly believe that such a dog’s breakfast can be rationally analyzed or diligenced at the company specific level. After all, the whole point of competitive markets is to sort out the winners, losers and also-rans at the sector, industry and sub-industry level. So buying the entire industry in a single stock amounts to embracing self-cancelling financial noise and undoing all the hard work of Mr. Market at the operating performance level.

Exchange traded funds, at bottom, are a product of the financial casinos, not the free market. They offer traders and speculators the chance to “bet on black” for just hours, days or weeks at a time based on little more than headlines and momentum. Not surprisingly, the XLE has now completed a round trip to nowhere during the last five years as the oil bubble re-erupted and then collapsed.

The massive amount of trading that occurred continuously up and down this arc was economically pointless. It was a playpen for punters and robo-machines. It added no allocative efficiency or market liquidity at all to the real enterprise of American capitalism.

XLE data by YCharts

The implication is straight forward. The ETF boom functioned as amarket accelerator on the way up. Speculative capital poured into these proliferating funds, and then was intermediated by Wall Street market makers into incremental demand for the thousands of individual stocks that comprise them.

This magnifying effect is important to understand because it highlights the artificiality and instability of today’s stock markets. To wit, every time an ETF started trading above the net asset value of the underlying stocks owing to speculator buying, fund providers issued new ETF shares to market makers. The latter, in turn, bought up a basket of shares on the stock exchanges representing the asset mix of the fund and swapped them for the ETF shares.

We call this the Big Fat Bid that helped undermine the two-way market forces that ordinarily keep speculation in check. But now that the worldwide financial bubble is cracking, we believe the dynamic will begin playing out in reverse. That is, ETFs will now become the Big Fat Offer that takes the market down at an accelerating pace.

The reason is straight forward. The $3 trillion world of ETFs is not an investor marketplace. It is a casino where the fast money moves in and out of short term rips, bubbles and flavors of the moment; and also a dangerous place where naïve retail investors have been lured to roll the dice on their home trading stations.

So as the global economy and financial markets slide into the long, deflationary cycle ahead, the hot money will flee sinking ETFs at an accelerating pace, thereby leaving homegamers shocked to find that they have been fleeced by Wall Street yet again. At length, retail level panic will ensue, causing a thundering implosion of the ETF sector.

What lies ahead for retail investors is probably worse. That’s because ETFs inherently embody a liquidity mismatch. Almost invariably the underlying stocks are not as liquid as the ETF shares which represent them.

This means that retail investors may be faced with painful episodes in which ETF shares gap down violently to deep discounts relative to their net asset value. Accordingly, if shareholders have attempted to protect their portfolios with stop orders, they may handed sharp losses; or they may just panic and sell.

The market plunge on August 26th last year provided a foretaste. In today’s markets, “trading halts” occur when a stock moves up or down too quickly relative to the trading range contained in market circuit breakers. Ordinarily, about 40 such trading halts occur each day, but during the August 26th plunge there were almost 1,300 such occurrences. And 78% involved ETFs, not individual stocks.

This is crucial because ordinarily only one-third of trading halts involved ETF shares. Stated in round numbers, there are ordinarily about 15 ETF trading halts per day, but on August 26th that number soared to 1,000.

Moreover, during this trial panic, the risk of large pricing gaps was painfully evident. The Vanguard consumer staples ETF called VDC, for example, plunged by 32% that day while the underlying holdings of the fund dropped by only 9%. Retail investors who panicked or who were sold out by stop loss orders were taken to the cleaners by the market makers.

The point here is not a plea for SEC regulation. Far from it!

Instead, the implication is that after a few more such episodes during this unfolding bear market——-which must inexorably happen due to the liquidity mismatch—–retail investors will become thoroughly disgusted with ETFs. They will then head for the hills right behind the fast money on Wall Street.

Yet ETFs are only one of the many FEDs (financially explosive devices) that have been fostered by our rogue central bankers. Wait until $700 trillion of financial derivatives start living up to the name Warren Buffett gave them before he went all in using them (“financial WMDs”).

Come to think of it – the crime does not lie in the anti-social behavior our Ben Franklins may occasionally facilitate. The crime is that we are ruled by a self-perpetuating elite of monetary cranks who have become so desperate that they want to eliminate something as natural and harmless as hand-to-hand currency.

Larry Summers is a pretentious Keynesian fool, but I refer to him as the Great Thinker’s Vicar on Earth for a reason. To wit, every time the latest experiment in Keynesian intervention fails – as 84 months of ZIRP and massive QE clearly have – he can be counted on to trot out a new angle on why still another interventionist experiment or state sponsored financial fraud is just the ticket.

Right now he is leading the charge for the greatest stroke of foolishness yet conceived. Namely, negative interest rates based on the rubbish theory that the “natural” money market rate of interest is at an extraordinarily low point. Accordingly, the central bank should drive the “policy rate” to sub-zero levels in order to achieve the appropriate level of “accommodation” in an economy that refuses to attain “escape velocity”.

As can’t be pointed out often enough, however, there is no such economic ether as “accommodation”. It’s just a blanket cover story for what Keynesian central bankers believe they are accomplishing by pegging interest rates below market clearing levels and by bending and mangling the yield curve to cause more investment.

But after 86 months it is evident that all of this putative monetary “accommodation” has failed. Falsifying the cost of money and capital can only work if it causes households and businesses to borrow more than they would otherwise; and to then lay credit based spending for consumption and investment goods on top of what can be funded out of current production and income. Another name for that is leveraging private balance sheets and thereby stealing production and income from the future.

With $62 trillion of public and private debt outstanding, however, the US economy has hit a economic barrier called Peak Debt. For all practical purposes, it can be measured as the macroeconomy’s aggregate leverage ratio, which now stands at 3.5X national income. That represents fully two extra turns of debt on the economy relative to the stable 1.50X ratio that prevailed during periods of war and peace and boom and bust during the century before 1970.

Stated differently, the Fed and other central banks have led the world economy into a planetary LBO over the last two decades or so. In the case of the US, the two extra turns of debt resulting from that rolling LBO amount to about $35 trillion.

Yes, that’s a load of anti-growth ballast that explains why there has been no “escape velocity”, and why the rate of real final sales growth since Q4 2007 is only1.3%compared to peak-to-peak historical rates of 2.5% to 3.5%.

And I use peak-to-peak advisedly because it is now clear after the recently released December business sales and inventory numbers that we are on the verge of a recession, if not already in one. Total business sales were down 4.6% from their July 2014 peak and the business sales to inventory ratio rose again to a recessionary high of 1.39X.

Yet the Vicar and his compatriots in the Eccles Building and on Wall Street insist on pushing harder on the credit string——even though Peak Debt means that household debt is still $400 billion below its pre- crisis peak and that the entire $2 trillion gain in business debt has been recycled back into the Wall Street casino via stock buybacks and mindless M&A deals. Real net investment in business plant, equipment and technology, in fact, is actually still 18% below its 2007 peak, and even the level which had been attained at the turn of the century.

So that brings us to the harebrained theory of negative interest rates and the supposed collapse of the “natural rate” of interest on the money market. The latter proposition is just unadulterated economic voodoo. It makes Art Laffer’s magic napkin look like a model of scientific formulation by comparison.

The truth is, there is only one “natural rate” of interest, and that’s the one produced in an honest financial marketplace via the interaction of savers and borrowers. No such rate now exists and hasn’t for decades owing to the massive intrusion of the Fed in the money market. Indeed, as a purely physical matter, even the so-called Federal funds market no longer exists because the Fed has asphyxiated it under a flood of $3.5 trillion of bond-buying and the resulting giant surplus of bank deposits.

So professor Summers is apparently speaking for the kid who killed his parents and then threw himself on the mercy of the courts on the grounds that he was an orphan. That is, interest rates are in the graveyard of history because the central banks buried them there.

Interest rate pegging and the Fed’s wealth effects doctrine have failed completely, but now Keynesians like Summers claim the contra-factual.

That means the Keynesian medicine didn’t work because the Fed didn’t pump enough monetary stimulants drugs into the nation’s already drug-addled body economic. So now we have to dig even deeper into the netherworld of financial repression in order to align borrowing costs with a non-existent natural rate of interest.

It’s another case of a policy target confected from whole cloth just like the 2% inflation target. But there is one overwhelming practical problem with NIRP. To wit, if it is pushed deeper and broader than just a few basis points of negative yield on deposits of excess bank reserves at the central bank, NIRP will surely cause a flight to old-fashioned bank notes. There will be a booming business in bank note moving and storage.

So, lo and behold, after all these years of doctoring the economy, Professor Summers and fellow travelers like Professor Peter Sands at Harvard, have up and joined the war on crime!

But their newfound abhorrence of crime amounts to an economist’s version of the NRA mantra that guns don’t kill, people do. In this case, it might be said that criminals don’t launder money, avoid taxes and commit act of terrorism, large denomination bills do!

Of course, the latter have been around for centuries. Yet suddenly every NIRP advocate on the planet has joined the campaign to abolish large bills including the Benjamin Franklin here and the EUR 500 note on the other side of the pond.

Thus, Professor Summers opined as followed in a recent Washington Post op ed:

The fact that — as Sands points out — in certain circles the 500 euro note is known as the “Bin Laden” confirms the arguments against it. Sands’ extensive analysis is totally convincing on the linkage between high denomination notes and crime. He is surely right that illicit activities are facilitated when a million dollars weighs 2.2 pounds as with the 500 euro note rather than more than 50 pounds as would be the case if the $20 bill was the high denomination note. And he is equally correct in arguing that technology is obviating whatever need there may ever have been for high denomination notes in legal commerce.

Let’s see. A million dollars worth of weed currently weighs about200 pounds. If push came to shove couldn’t El Chapo have the mules who deliver it to the street carry 50 pounds of bills on the backhaul? Better still, if drug money laundering is such a huge social blight, why not legalize the drug trade and turn the business over to Phillip Morris?

They would surely use digital money to pay their vendors. And if we want to get rid of tax evasion does the good professor really believe that Wall Street high rollers and silicon valley disrupters or just every day rich people actually get paid for whatever they do in bank notes?

The fact is, it is gardeners, waitresses and delivery boys who get paid in cash, not people with meaningful incomes. Yet bringing such putative slackers to justice doesn’t require the abolition of cash in any event. Just exempt them from income and payroll taxes entirely and let them pay their societal dues at the cash register when they purchase goods and services.

In short, there is one reason alone for the sudden campaign to abolish large denomination bills. It is a necessary predicate for the imposition of NIRP. That is to say, it would pave the way for central bank mandated confiscation of the wealth and savings of millions of American citizens in the pursuit of a cockamamie theory that would bring about the final destruction of honest price discovery and financial discipline in the Wall Street casino.

Surely, there is not much more of such destructive intervention that can be tolerated before the booby-traps of leverage and risk that have been built up over the last two decades, but especially since the financial crisis, blow sky high. Indeed, the very idea that the foolish advocates of Keynesian central banking would even entertain the notion of providing outright subsidies to carry trade gamblers—–and that’s where money market NIRP would end up——is a warning sign of the danger that lurks in the financial misty deep.

During the printathon since 2008, Central bankers have been massively and relentlessly deforming financial markets and rewarding the most outlandish and unstable forms of leveraged gambling and risk-taking throughout the warp and woof of the financial system. Yet they have no more clue about the financial time bombs they have planted than they did last time around when CDS and CDOs squared were erupting everywhere.

It is only a matter of time, and a few more bear market rallies, before the meltdown commences again. Indeed, when the impending global recession becomes fully evident, the gamblers in the Wall Street casino will panic like never before.

After a 30-year bubble, they have come to believe that the central banks are infallible and that all economic downturns and market corrections are quickly remedied with new rounds of monetary stimulus. But that is not a permanent financial truth; it’s a false generalization based on a fabulous one-time monetary trick that is already played out.

To wit, central banks have used up their dry powder. After more than two decades of reckless monetary pumping, they are now stranded on the zero bound and possessed of hideously bloated balance sheets.

So the correction scenario this time will be very different. There will be no quick reflation, meaning that the liquidation of economic malinvestments and overvalued financial assets will run for years.

In fact, during the coming down-cycle, the central banks may turn out to be wreckers, not saviors. As they resort to increasingly novel and illogical maneuvers such as negative interest rates (NIRP) they are generating fear, not confidence.

There can be no better proof than what has transpired in Japan since its lunatic central banker, Haruhiko Kuroda, announced a shift to NIRPwithin days after he said it was off the table. Since his January 29 statement, however, the Japanese stock market has plunged by 16% from its early January level and 25% since last summer’s peak, thereby wiping out much of the three-year long stock bubble generated by Abenomics.

^N225 data by YCharts

Nor is Japan’s stumble an isolated case. Warning signs on the epochal shift now underway continue to accumulate on all fronts. The bellwether economies of Asia started the year with a sharp plunge, including a 11.5% export decline compared to last January in China, a 13.5% drop in India and an 18.5% plunge in South Korea.

Likewise, Germany ended 2015 with an unexpected decline in exports and industrial production, while Japan’s trade figures also slipped badly—-with exports down 8% and imports off by 18% versus prior year. Consequently, the Japanese economy posted a recessionary 1.4% contraction of GDP in Q4.

There is no better weathervane on the global economy than the Baltic Dry Index because it captures the daily pulse of global shipments of grains, iron ore and the rest of the commodity complex. The fact that it has now plunged to an all-time low since records began in 1985 underscores that worldwide industrial activity is sinking rapidly.

In response to these deflationary currents, financial markets have retreated sharply on a worldwide basis. Among 44 significant international equity markets, nearly half are already in bear market territory as signaled by a drop of 20% or more from recent highs. And some of the most pivotal markets in the world——-Germany (DAX), Japan and China—–are down by 30% or more.

Not surprisingly, these drastic declines have so far only dented the surface on Wall Street. The unreconstructed bulls are already saying that the correction is over and are urging their clients to once again buy the dip. Nearly ever one of the major banking houses have year-end price targets for the S&P 500 well above current levels. These include a gain of 11% at Goldman, 15% at Morgan Stanley, 16% at Barclay’s and 17% at RBC Capital.

A cynic might dismiss this ebullience as merely an exercise in the usual Wall Street hockey stick game. After all, you can’t sell stock, ETFs and other financial products to investors when you are projecting a down market, and so they never do.

Yet chalking these dubious targets off to salesmanship would be to underestimate the magnitude of the coming crash.The truth of the matter is that Wall Street gamblers, like the Jim Carrey character in The Truman Show, have lived in the bubble for so long that they no longer even remotely grasp the artificiality and unsustainability of the entire financial system.

We think the chart below puts this in perspective. For the better part of three decades, the financial system in the US has been expanding at nearly twice the rate of GDP growth. Even a vague familiarity with the laws of compound arithmetic reminds us that the resulting ever-widening gap between economic output and the market value of stock and debt obligations can’t continue.

But there is an even larger point. Namely, that the weakening performance of the US economy during the last two decades did not warrant the drastic increase in the capitalization rate implied by the chart in the first place.

Stated differently, equities and debt must ultimately be supported by interest and dividends extracted from the flow of national income (GDP). Historically, the stable US financial capitalization rate—that is, the combined value of debt and equity outstanding— had been about 2.0X national income. But beginning with Greenspan’s conversion to money printing after the financial meltdown of October 1987, the capitalization rate begin to steadily climb and never looked back.

Now it amounts to nearly 5.4X national income. Yet this has occurred during a period when the trend growth rate of the US economy has been cut in half——from more than 3.0% per annum to less than 1.3% during the eight years.

Measured in dollar totals, the sum of equity and debt outstanding in the US in 1987 was $11 trillion. Today it exceeds $93 trillion. No wonder asset gatherers like Blackrock have exploded in scale!

But that’s also why they are heading for a big fall. As the post-bubble epoch of global recession and financial deflation and liquidation unfolds, the $93 trillion US financial bubble shown below will contract sharply, as will its equivalent worldwide total of $300 trillion.

So we are looking at tens of trillions of financial asset shrinkage in the years ahead. And nowhere will that implosion be more dramatic than in the ETF sector.

As shown in the chart below, the number of these entities has grown from about 600 to 5,500 in the last 12 years, and AUM has exploded from $450 billion to $3 trillion.That’s a 21% compound rate of growth since 2005.Even more significantly, almost all of that growth occurred after the 2008 financial crisis.

So let’s cut to the chase. Prior to Greenspan’s dotcom bubble, ETFs did not even exist, and they would never thrive on an honest free market. That’s because their fundamental appeal is to professional speculators and traders and to homegamers who like to bet on the financial ponies.

By contrast, there is no reason why real long-term investors would want to own a huge, motley basket of banking stocks or energy stocks or the likes of the biotech ETF portfolio. The latter (IBB) includes 150 different stocks including nearly 100 start-ups whose science is extremely difficult to assess and whose P&Ls are largely non-existent.

The sole purpose of the IBB, therefore, was to enable speculators to pile on to the momentum trade in biotech stocks which incepted about 2012. This momentum trend was then turbo-charged by the inflow of speculative capital into this sector through IBB and other ETF’s.

The same thing happened with the energy ETFs. One of the major ETF baskets in this sector is called XLE and it includes 40 energy companies ranging from giant integrated producers like Exxon to refiners like Valero, to oilfield services companies like Halliburton, to small E&P companies like Newfield Exploration. The iShares equivalent is called IXC and it is even more diversified with 96 companies spread among an even greater diversity of sizes, specializations and geographies.

Needless to say, no long-term investor would possibly believe that such a dog’s breakfast can be rationally analyzed or diligenced at the company specific level. After all, the whole point of competitive markets is to sort out the winners, losers and also-rans at the sector, industry and sub-industry level. So buying the entire industry in a single stock amounts to embracing self-cancelling financial noise and undoing all the hard work of Mr. Market at the operating performance level.

Exchange traded funds, at bottom, are a product of the financial casinos, not the free market. They offer traders and speculators the chance to “bet on black” for just hours, days or weeks at a time based on little more than headlines and momentum. Not surprisingly, the XLE has now completed a round trip to nowhere during the last five years as the oil bubble re-erupted and then collapsed.

The massive amount of trading that occurred continuously up and down this arc was economically pointless. It was a playpen for punters and robo-machines. It added no allocative efficiency or market liquidity at all to the real enterprise of American capitalism.

XLE data by YCharts

The implication is straight forward. The ETF boom functioned as amarket accelerator on the way up. Speculative capital poured into these proliferating funds, and then was intermediated by Wall Street market makers into incremental demand for the thousands of individual stocks that comprise them.

This magnifying effect is important to understand because it highlights the artificiality and instability of today’s stock markets. To wit, every time an ETF started trading above the net asset value of the underlying stocks owing to speculator buying, fund providers issued new ETF shares to market makers. The latter, in turn, bought up a basket of shares on the stock exchanges representing the asset mix of the fund and swapped them for the ETF shares.

We call this the Big Fat Bid that helped undermine the two-way market forces that ordinarily keep speculation in check. But now that the worldwide financial bubble is cracking, we believe the dynamic will begin playing out in reverse. That is, ETFs will now become the Big Fat Offer that takes the market down at an accelerating pace.

The reason is straight forward. The $3 trillion world of ETFs is not an investor marketplace. It is a casino where the fast money moves in and out of short term rips, bubbles and flavors of the moment; and also a dangerous place where naïve retail investors have been lured to roll the dice on their home trading stations.

So as the global economy and financial markets slide into the long, deflationary cycle ahead, the hot money will flee sinking ETFs at an accelerating pace, thereby leaving homegamers shocked to find that they have been fleeced by Wall Street yet again. At length, retail level panic will ensue, causing a thundering implosion of the ETF sector.

What lies ahead for retail investors is probably worse. That’s because ETFs inherently embody a liquidity mismatch. Almost invariably the underlying stocks are not as liquid as the ETF shares which represent them.

This means that retail investors may be faced with painful episodes in which ETF shares gap down violently to deep discounts relative to their net asset value. Accordingly, if shareholders have attempted to protect their portfolios with stop orders, they may handed sharp losses; or they may just panic and sell.

The market plunge on August 26th last year provided a foretaste. In today’s markets, “trading halts” occur when a stock moves up or down too quickly relative to the trading range contained in market circuit breakers. Ordinarily, about 40 such trading halts occur each day, but during the August 26th plunge there were almost 1,300 such occurrences. And 78% involved ETFs, not individual stocks.

This is crucial because ordinarily only one-third of trading halts involved ETF shares. Stated in round numbers, there are ordinarily about 15 ETF trading halts per day, but on August 26th that number soared to 1,000.

Moreover, during this trial panic, the risk of large pricing gaps was painfully evident. The Vanguard consumer staples ETF called VDC, for example, plunged by 32% that day while the underlying holdings of the fund dropped by only 9%. Retail investors who panicked or who were sold out by stop loss orders were taken to the cleaners by the market makers.

The point here is not a plea for SEC regulation. Far from it!

Instead, the implication is that after a few more such episodes during this unfolding bear market——-which must inexorably happen due to the liquidity mismatch—–retail investors will become thoroughly disgusted with ETFs. They will then head for the hills right behind the fast money on Wall Street.

Yet ETFs are only one of the many FEDs (financially explosive devices) that have been fostered by our rogue central bankers. Wait until $700 trillion of financial derivatives start living up to the name Warren Buffett gave them before he went all in using them (“financial WMDs”).

Come to think of it – the crime does not lie in the anti-social behavior our Ben Franklins may occasionally facilitate. The crime is that we are ruled by a self-perpetuating elite of monetary cranks who have become so desperate that they want to eliminate something as natural and harmless as hand-to-hand currency.

No comments:

Post a Comment